Why Consider Outsourcing Your Company's Accounting and Finance Function to Kreischer Miller?

Companies often find it challenging to recruit and retain accounting and finance department staff with the necessary skills to effectively process transactions, provide safeguards over assets, deliver readily available financial information, and offer feedback on matters impacting the business. Beyond the management headaches this entails, business owners also can become frustrated by a lack of automation and quick access to vital financial information.

The question becomes, is it worth investing your valuable time to build and manage an accounting department or would it be more effective to outsource your accounting function to a company that excels in providing these types of services?

Benefits of outsourced accounting and finance services:

- Cost savings

- Eliminate the time and cost of hiring accounting department staff

- Reduce the risk of employee turnover

- Consistent quality and oversight over financial reports

- Reallocate time and resources to growing your business

- Leverage technology to automate manual tasks

- Consistency in accounting and financial best practices and operating policies

We invite you to connect with us to learn more about how your company can benefit from outsourcing its accounting and finance functions.

Kreischer Miller’s Outsourced Accounting & Finance Services

Bookkeeping and Core Accounting Services

Accurate, timely, and organized financial data is the foundation of sound decision-making. Our services include:

- Timely and accurate recordkeeping

- Cash or accrual accounting

- Class/program tracking

- Accounts Payable (AP) Management

- Accounts Receivable (AR) Invoicing

- Monthly reconciliations

- Month-end close and reporting package

- 1099 preparation

Financial Insights and Support

We turn your numbers into actionable insights to help you lead with confidence:

- Budget preparation and budget-to-actual reporting

- Executive summaries and enhanced reporting

- Dashboards with key performance indicators (including non-financial metrics)

- Monthly or quarterly finance meetings with your accounting manager

- Audit support

Strategic Financial and Leadership Advisory

We help you plan for the future and stay ahead of challenges:

- Financial Planning & Analysis (FP&A)

- Near-term cash flow forecasting with weekly updates

- Issue ranking diagnostics

- One-page accountability plans

Additional Services

We offer a range of specialized services to meet your evolving needs (these would all link to relevant service pages):

- State and local tax compliance, including sales and use tax filings

- Business valuations

- Financial due diligence and Quality of Earnings reports for sale preparation

- Transition and exit planning

- Succession planning

- Talent advisory

- IT advisory

- And more—view all of our services (link “view” to Services landing page)

How We Work Together

Our client service model is flexible, depending on your company’s needs. We can correspond with you on a weekly, bi-weekly, or monthly basis, either virtually/electronically or via phone/video call.

By working with Kreischer Miller, you’ll also have access to the full resources and capabilities of a public accounting firm. Whether you need support with buying or selling a company, obtaining a business valuation, assistance with succession planning, or navigating estate and gift planning, our experienced accounting, tax, and advisory professionals are here to help.

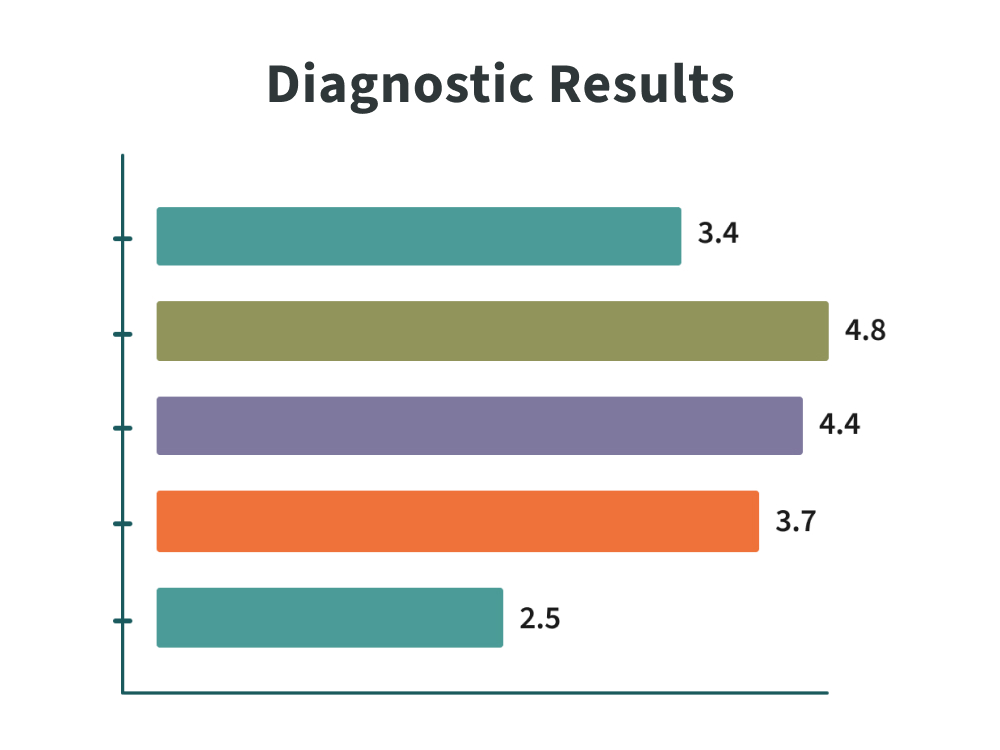

Outsourced Accounting Benefits Diagnostic

Find out if outsourcing is right for your organization

To help you better understand where your organization stands—and how outsourcing your accounting function might benefit you—we invite you to complete a short diagnostic tool. Upon submitting your answers to the diagnostic questions, you will receive an autogenerated report that will include a unique summary of your results as well as a list of next steps and action items.

Learn MoreOur Technology Stack