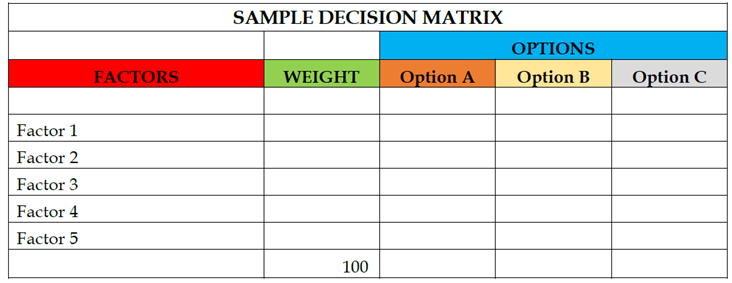

The purpose of a decision matrix is to pass various options through a selection filter in order to reduce the subjectivity in making your ultimate choice. When decisions are made, it is rare that the factors that influence your decision are weighted equally. Consider using the following process when making individual choices or working in a group:

Step 1. Create a list of the options that you could choose from and enter them across the top of the matrix shown below.

Step 2. Brainstorm the factors that impact the decision being made.

Step 3. Select the factors that are most relevant and list them in the left column of the matrix. I recommend five factors, but no more than 10.

Step 4. Weight the factors individually to total 100.

Step 5. With the weighting in place, you can now go ahead and score each of your selected options against each factor. It is highly recommended that your first option be used as your benchmark at a total of 50. Then work through the remaining options one at a time (comparing against your first option).

Step 6. Total all the scores.

Step 7. Highlight the highest total, which is the best option based on the weighted factors.

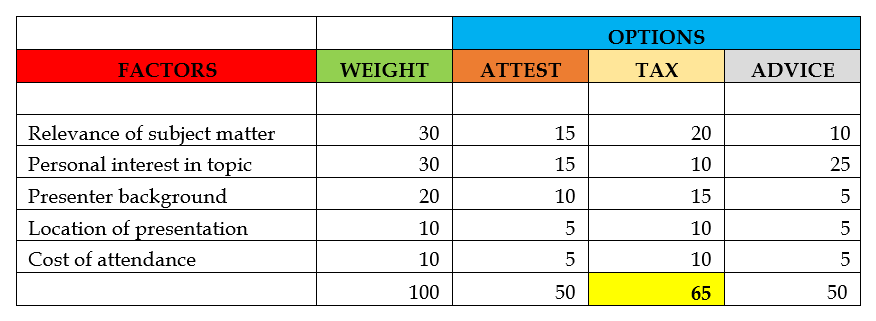

Following is an example of a decision matrix that I used in selecting a continuing education course:

As you can see, I was able to easily identify my best option (the Tax course) based on the factors that were important to me and how each option scored for each factor.

I strongly recommend making a habit of using a decision matrix when exploring options and making decisions.

Robert S. Olszweski is a director with Kreischer Miller and a specialist for the Center for Private Company Excellence. Contact him at Email or 215.441.4600.

You may also like: