The number of eligible participants in your plan at the beginning of each plan year is the determining factor for whether your plan requires a DOL audit. The definition of eligible participant includes:

The number of eligible participants in your plan at the beginning of each plan year is the determining factor for whether your plan requires a DOL audit. The definition of eligible participant includes:

- Current employees who are deferring and/or receiving contributions

- Current employees who are eligible to participate based on the plan document’s requirements but have elected not to contribute

- Terminated participants who still have an account balance in the plan

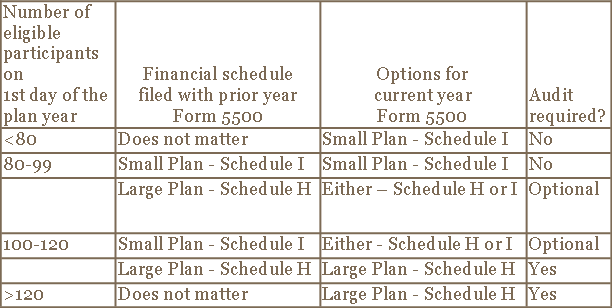

Generally, plans with 100 or more eligible participants are categorized as large plans and are required to attach an audit report to their Form 5500 filing. However, this is only applicable for plans in their initial year of existence. Plans that have existed for more than one year are subject to certain exceptions, commonly referred to as the 80-120 rule.

The table below illustrates various options based on the number of eligible participants at the beginning of the year:

Plans with more than 120 eligible participants at the beginning of the plan year automatically fall under the audit requirement with no applicable exceptions. Plans with fewer than 100 participants are exempt from the audit requirement, unless the plan trustee requests an audit. If a plan currently has 100-120 eligible participants but exceeded 120 participants in the prior year, an audit is required until the eligible participant count falls below 100. If a prior year audit was not required and the plan has 100-120 eligible participants, the plan administrator can elect to undergo an audit, but it is not required by the DOL.

If you have any uncertainty about the number of eligible participants in your plan, whether an audit is required, or questions regarding the determination of eligible participants, please contact us for guidance.

Roman Leshak can be reached at Email or 215.441.4600.