What a difference a few months can make. In our June 2024 M&A trend update, we noted that while economic uncertainty caused volatility in the private company M&A market in 2023, trending multiples through Q1 2024 seemed to indicate an anticipated recovery for 2024.

However, by Q4 2024, the economy had grown at a slightly slower rate than previously anticipated, in part due a business decline amidst the uncertainty of the presidential election.

How did the year end up for the M&A market? This article provides a summary of key information from the DealStats Value Index for Q4 2024, with a focus on private companies.

M&A Trends for Q4 2024

Multiples saw a significant fluctuation throughout 2024, with a sudden decrease leading into the third quarter of 2024. The median selling price per earnings before interest, taxes, depreciation, and amortization (EBITDA) across all industries fluctuated throughout the year: 3.5x at Q4 2023, 4.3x at Q1 2024, 4.8x at Q2 2024, 3.2x at Q3 2024, and 3.5x at Q4 2024.

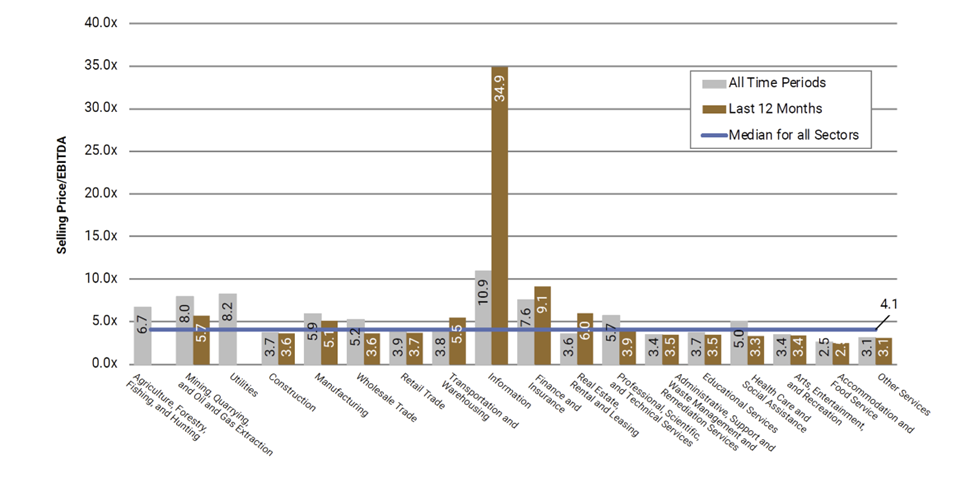

EBITDA multiples continued to vary significantly by industry. Over the past twelve months, the Information sector yielded the highest selling price for EBITDA at 34.9x, followed by Finance and Insurance at 9.1x. The Accommodation and Food Service sector yielded the lowest selling price for EBITDA at 2.5x, with Other Services trailing not far behind at a selling price for EBITDA at 3.1x.

The table below illustrates the median selling price per EBITDA by industry for private companies:

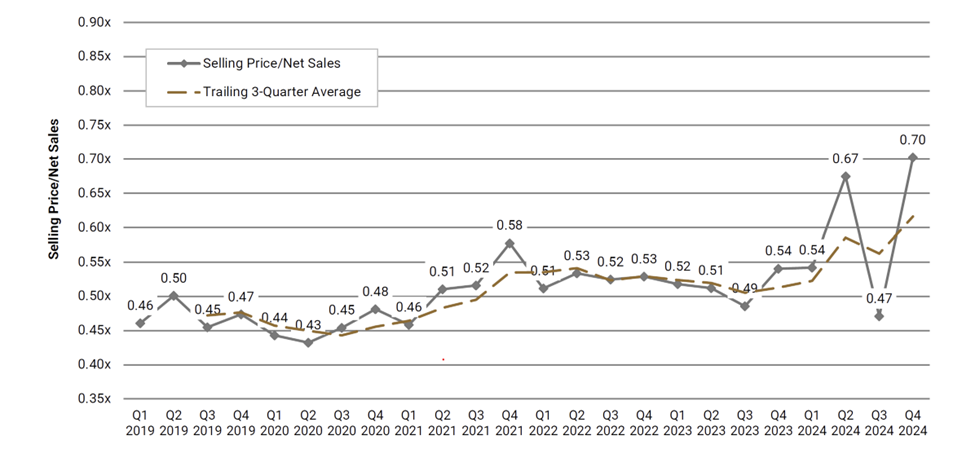

The median selling price per net sales for private companies increased from 0.54x at Q4 2023 to 0.7x at Q4 2024.

The table below illustrates the median selling price per net sales for private companies:

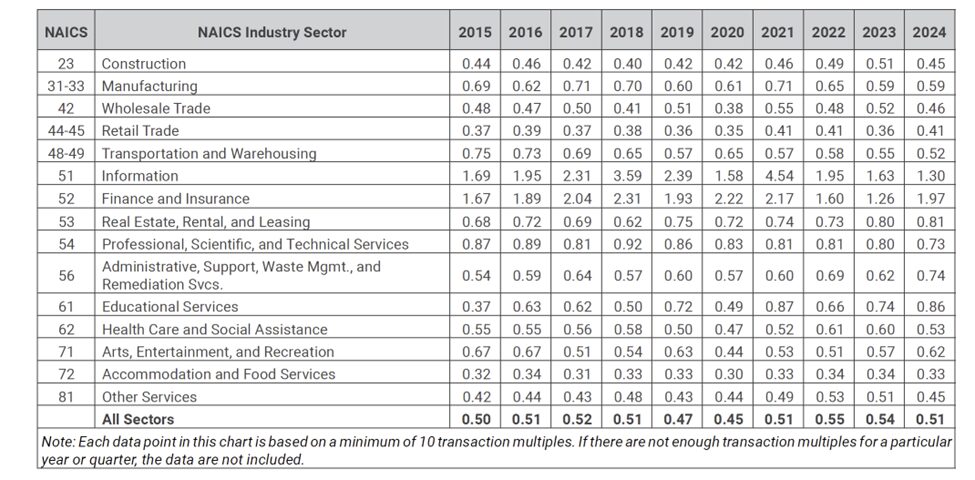

Median net sales multiples for private companies decreased in eight of the 15 industry sectors in 2024. Two notable sectors were Information and Wholesale Trade, which declined 20 percent and 12 percent, respectively.

The following table illustrates the median selling price per net sales by sector for private companies :

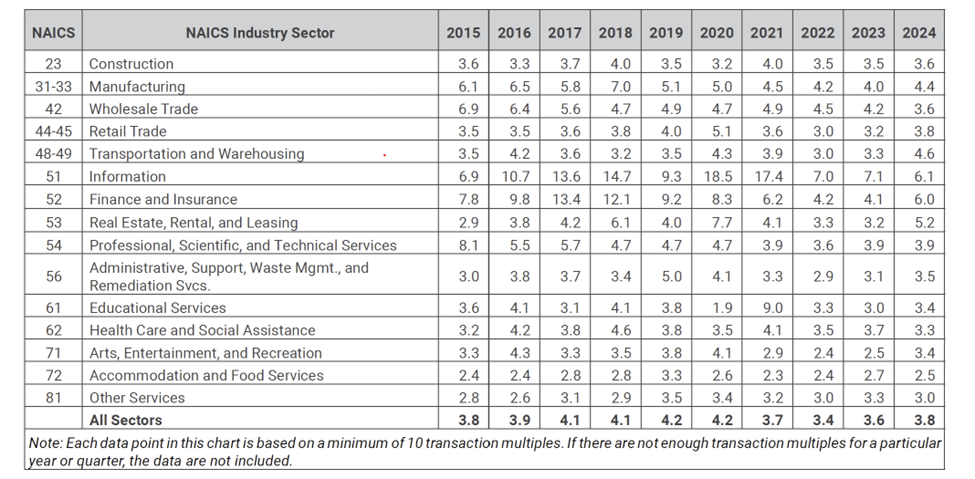

Median EBITDA multiples saw a positive increase in most sectors in 2024. Notable increases occurred in Real Estate, Rental and Leasing, and Finance and Insurance, with increases of 62 percent and 46 percent, respectively.

The following table illustrates the median selling price per EBITDA by sector for private companies:

What Does This Mean for Your Business?

Overall, multiples have dipped slightly, but they appear to be trending upwards based on market optimism.

While valuation multiples may not provide an exact selling price for your business, they serve as valuable indicators of industry and market trends. The selling price is influenced by many other factors beyond valuation multiples, such as economic conditions, market demand, and financial performance. Understanding these factors and how they interact can help you set realistic expectations and develop strategies to enhance your business's value when considering a sale.

Learn More About Kreischer Miller’s M&A/Transaction Advisory Services

If you would like to learn more about how your company may be viewed in the marketplace, please contact us or click here to learn more about our M&A/Transaction Advisory Services.