In a June 2023 article, we discussed how economic uncertainty, rising costs of capital, and capital markets caused volatility in the private company M&A market from 2022 to 2023. However, as we look at trending multiples through Q1 2024, a sudden recovery is evident as uncertainties about the U.S. economy have softened and confidence has been restored among investors.

This article will provide a summary of information from the DealStats Value Index for Q1 2024, with a focus on private companies.

M&A Trends for Q1 2024

Multiples saw a slight fluctuation throughout 2023 and a sudden increase into the first quarter of 2024. The median selling price per earnings before interest, taxes, depreciation, and amortization (EBITDA) across all industries fluctuated from 3.2x at Q1 2023, 3.6x at Q2 2023, 3.4x at Q3 2023, 3.5x at Q4 2023, and then increased to 4.3x at Q1 2024.

EBITDA multiples throughout 2023 and Q1 2024 appeared more in line with historical levels from 2018 to 2021, ranging from 3.5x to 5.0x EBITDA.

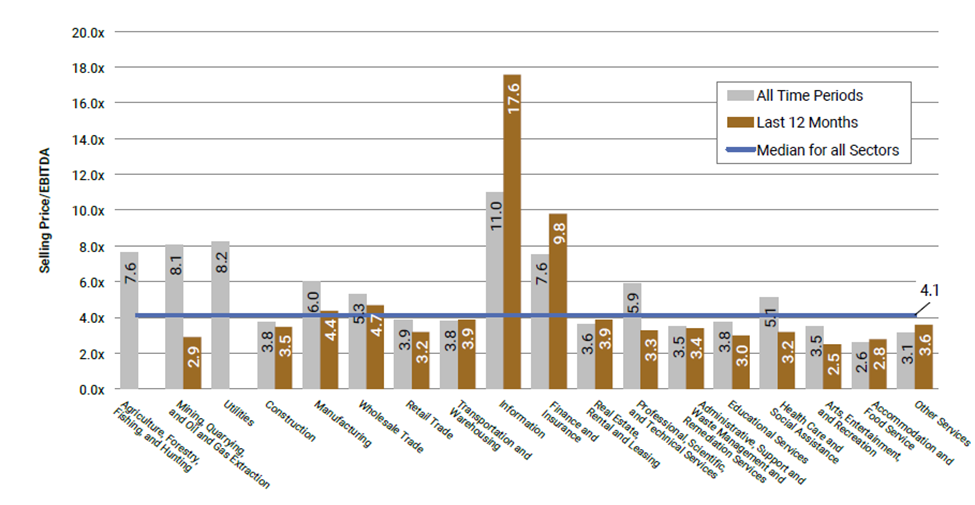

EBITDA multiples continued to vary significantly by industry. Over the past twelve months, the information sector yielded the highest selling price for EBITDA at 17.6x, followed by finance and insurance at 9.8x. For the last twelve months, the arts, entertainment, and recreation sector yielded the lowest selling price for EBITDA at 2.5x, with the food service sector trailing not far behind at a selling price for EBITDA at 2.8x.

The table below illustrates the median selling price per EBITDA by industry for private companies:

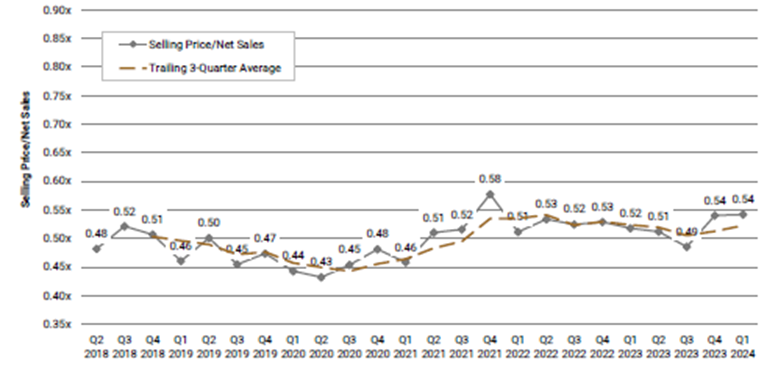

Median selling price per net sales for private companies remained consistent at 0.52x at Q1 2023 vs. 0.54x at Q1 2024.

The table below illustrates the median selling price per net sales for private companies:

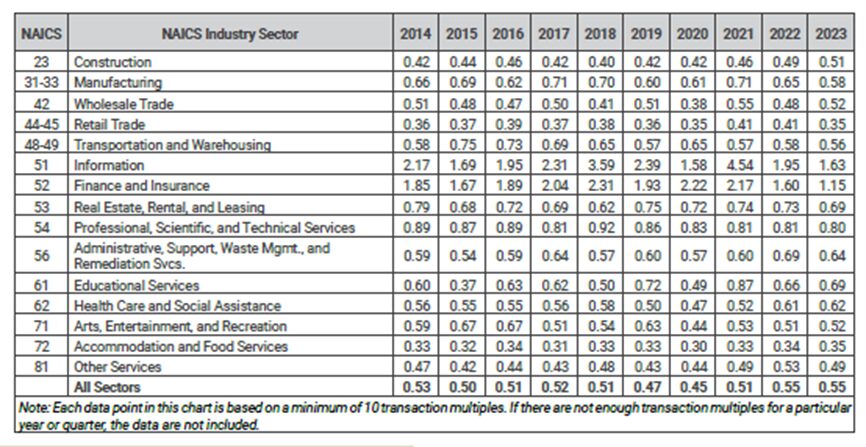

Median net sales multiples for private companies decreased in nine of the 15 industry sectors in 2023. Two notable sectors were information and finance and insurance, which declined 16 percent and 28 percent, respectively.

The following table illustrates the median selling price per net sales by sector for private companies:

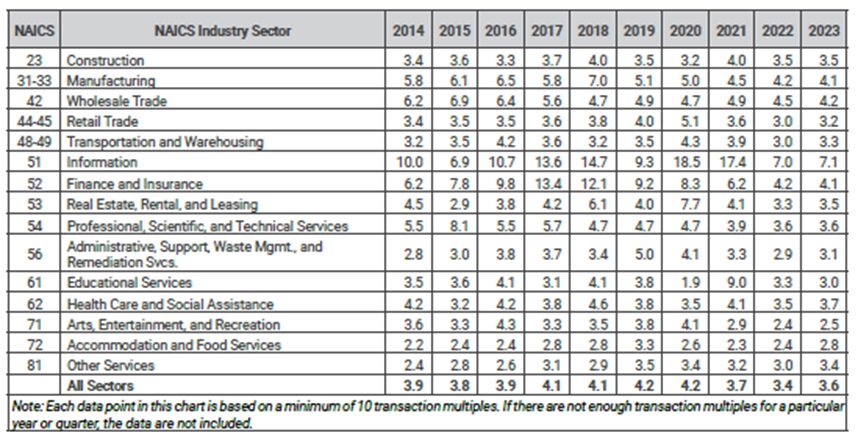

Median EBITDA multiples saw a positive increase in most sectors in 2023. Notable increases occurred in accommodation and food services, and other services, with increases of 18 percent and 11 percent, respectively.

The following table illustrates the median selling price per EBITDA by sector for private companies:

What Does This Mean for Your Business?

Obtaining insights into the latest trends and multiples within your industry can assist you in assessing the value of your business and better prepare you for a potential transaction. If you have any questions or would like to learn more about this process, please contact us.