When private company owners contemplate how they will transfer out of their business, their attention often turns to the technical aspects of the situation. They focus on things like how much the business is worth, what the M&A climate is like in their industry, and how they can save on taxes. While these are all important considerations, it’s a narrow view of all that a business transition entails and it can actually lead to mistakes because it’s putting the cart before the horse, so to speak.

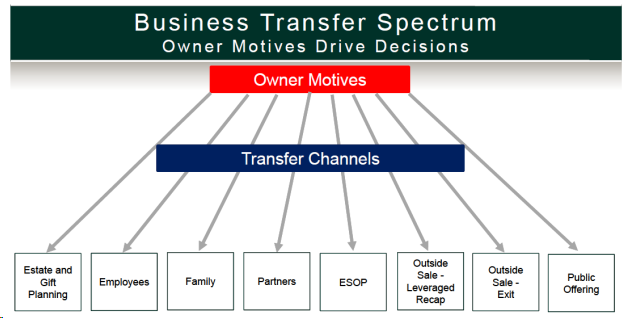

We believe that the first thing any business owner should do when contemplating a transition is to get very clear about their motives. There are many transfer channels (choices) that are available to an owner who is transitioning a company. The key is to be aware of these choices and, more importantly, take time to thoughtfully consider what is motivating you to do the transfer.

The one consistent motive discussed by owners and advisors is money – which we can all agree is critically important. However, the importance of money as a motive can vary depending on the owner’s circumstances. Plus, it is usually not the only motivating factor in a transfer (in fact, it may not even be the most important factor). Other common motives are family, employees, business legacy, community, and the owner’s role in the business after the transition. Every business owner we’ve worked with on a transition has had different motives based on their own unique circumstances.

The reason that clarity about your motives is so important is that they may direct you to different conclusions about which transfer strategy is the best fit. Consider the Business Transfer Spectrum chart below and the many options available to an owner.

Adapted from “Private Capital Markets” by Robert T. Slee.

It’s important to understand that each of the options on this chart comes with tradeoffs – advantages and disadvantages to each choice. An awareness and understanding of all of these options is critical, but clarity of motives is what gives an owner the ability and the freedom to choose the right strategy for their transition.

Most owner entrepreneurs are very independent-minded people who have built their businesses the way they want – on their terms. So it makes sense that they would want to transition their businesses in the same way. Having clarity about your motives is the first step to getting there.