Accounting, by its nature, is a rear-facing activity that is focused on recording historical events. While accurate recording of transactions is important, many companies are missing out on the potential of what the accounting function could be doing in their business by viewing it so narrowly.

This narrow view tends to come from the fact that the accounting function is not directly part of profit-making activities such as purchasing, sales, operations, and customer service. Because of this, many companies view it simply as overhead, with the goal of minimizing costs. These companies make the mistake of not properly investing in the people, processes, and technology to turn the accounting function into a forward-looking activity that creates value for the business.

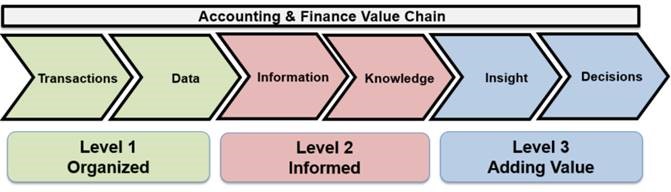

However, successful companies understand that the accounting function can create a great deal of value when it is properly structured and integrated into the business. The following depicts the “value chain” of activities in an accounting department.

Level 1 – Companies at Level 1 are not getting much from accounting and are typically not investing in it properly. These companies are just capturing data and not doing much with it.

Level 2 – Companies at Level 2 are turning the data into information and knowledge but don’t have the people or technology to create insight into the business and help drive it forward.

Level 3 – Companies at Level 3 are getting a great deal of value out of their accounting and finance group, and it plays a critical part in driving the business forward.

Here are a few questions to help you assess where you stand in the accounting and finance value chain.

- Do I get accounting information infrequently or do I get a steady stream of good information often?

- Is the information delivered on a timely basis or is it often delayed or too late to be useful?

- Is the information accurate, or do I find mistakes or have a lot of unanswered questions?

- Is the accounting information I use mostly past history or do I get information that helps me make forward-looking decisions in the business?

- Is my lead person in accounting and finance capable of participating in forward-looking activities and are they considered a peer to the other key executives at my company?

- Is the accounting and finance function operating efficiently, effectively, and on par with the other key parts of my business?

- What are my expectations from accounting and finance? Am I pushing it to contribute more to the success of the company or do I view it as overhead?

In the most well-run and profitable companies we work with, the accounting and finance team contributes a significant amount of value. If you don’t feel you are there, perhaps it is time to make an assessment of your situation and develop a plan to get you there.