At Kreischer Miller, we use a transition planning model with our clients that has three critical high-level elements: business readiness, owner emotional readiness, and owner financial readiness.

Owner financial readiness is the easiest of the three to address but it is often overlooked when contemplating a transition. However, this element is critical because it answers a basic question that is on the mind of every business owner: How much money is enough?

In our experience, most private company owners have multiple transfer goals in addition to money. These can include family, community, employees, etc. It is rare that the maximum price an owner can obtain for their business is the only issue on their mind. Therefore, knowing how much money will be enough to live the way an owner wants after the transfer allows them to identify and make tradeoffs in order to satisfy other transfer goals.

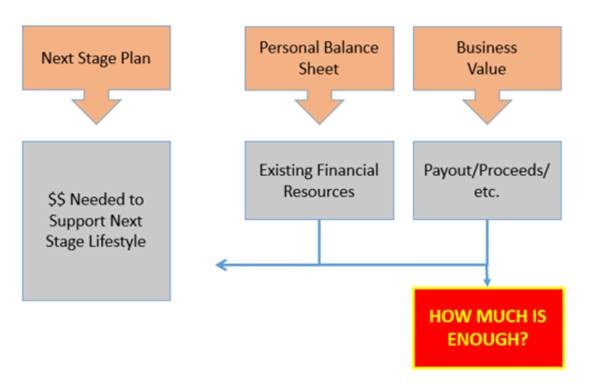

The key components of this analysis are illustrated on the following chart:

- Next Stage Plan – You need to give some thought to what your next stage of life will look like from the standpoint of the lifestyle you want to lead. Getting clear on your lifestyle choices should give you an estimate of the amount of money you’ll need annually – after taxes – to support your lifestyle.

- Personal Balance Sheet – This step is pretty straightforward in that you’ll need to develop a personal balance sheet that includes the value of all your assets including investments, bank accounts, retirement accounts, and real estate net of any liabilities. This gives you a picture of the total financial resources available to you in order to achieve the financial elements of your next stage plan.

- Business Value – For most private owners, the business is the biggest asset that they own. Knowing the value of that business is a critical but often overlooked step because owners often only expect to learn this from a transaction. However, with the help of a business valuation professional, you should be able to get a conservative estimate of what the business is worth and it must be part of your long range financial plan.

Once you’ve compiled your next stage plan, your personal balance sheet, and the value of your business, you can get a sense of how flexible you can be with the transfer price you can accept and how it can be paid – whether you’ll need all of the money up front or it can be paid in installments over time.

Certainly there are complexities to consider (taxes, life expectancy, etc.) but these three pieces of data are the building blocks of the analysis. With the help of a CPA or financial planner, you should be able to get a good picture of where you stand financially.

Do you know how much is enough?