In August 2016, the Financial Accounting Standards Board (FASB) issued Accounting Standards Update No. 2016-14, Presentation of Financial Statements of Not-for-Profit Entities. As a result, there are many new reporting requirements for NFP/For Purpose entities effective in 2018 for December year-ends and in 2019 for all other NFP/For Purpose entities. This alert describes the new requirements associated with the presentation of net assets, a few helpful tips, and some common obstacles to avoid, while preparing to implement the provisions of the new standard.

Compliance with the New Standard's Net Asset Composition and Required Disclosures

With the implementation date for this new standard approaching quickly for those organizations with years ending December 2018, and with all other organizations with years ending 2019 following close behind, now is the time to start thinking about how this new requirement will impact your organization.

As a result of FASB Accounting Standards Update No. 2016-14, Presentation of Financial Statements of Not-for-Profit Entities (ASU), net assets will be reduced from the current three classifications (unrestricted, temporarily restricted and permanently restricted) to two classifications: net assets without donor restrictions, that includes board designated, and net assets with donor restrictions which includes temporarily and permanently restricted.

Many would think that was great news, BUT with the new enhanced disclosure requirements, you will need to pay closer attention to the detail and to the way you track your donor restricted net assets.

Net assets without donor restrictions, currently unrestricted net assets, still houses the board designated net assets. However, the ASU requires additional disclosures regarding the amounts and purposes of board designations, appropriations and similar actions that result in self-imposed limits on the use of resources without donor-imposed restrictions as of the end of the period.

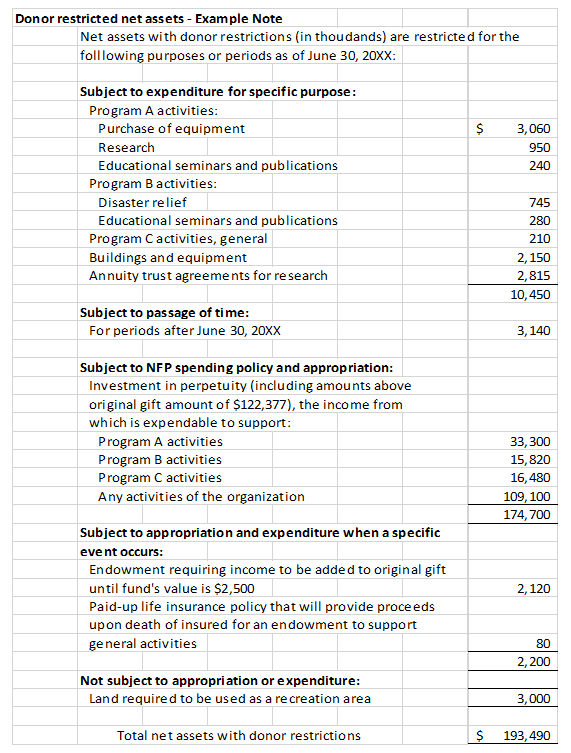

Although, the ASU is rather flexible to where within the financial statements this information should be presented, and how much detail to provide, it does suggest that information about the nature and amounts of different types of donor-imposed restrictions be provided either by reporting their amounts on the face of the statement of financial position or by including relevant details in the notes to the financial statements (an example of a note disclosure that was provided in the ASU follows this newsletter).

Per the ASU, the information required to be disclosed for net assets with donor restrictions are as follows:

- Composition of net assets with donor/grantor restrictions

- Emphasis on how/when resources (net assets) can be used

- Specified purpose(s)

- Specified time(s)

- Perpetual (endowment, i.e., "funds of perpetual duration")

- Quantitative and qualitative information about board designations

The types of donor restrictions you may want to consider breaking out are as follows:

- Assets, such as land or works of art, donated with stipulations that they be used for a specified purpose, be preserved and not be sold.

- Support of particular operating activities.

- Investment for a specified term (time restricted).

- Used in a specified future period.

- Acquisition of long-lived assets.

- Investments held in perpetuity.

- Beneficial interest.

Although, it may take some additional work to track net assets with donor restrictions in greater detail, there will also be a benefit. You will likely need the information gathered to complete the new required liquidity note disclosure (a topic for next quarter's newsletter).

In preparing for implementation of the new net asset requirements, there are some matters that management may want to consider:

- Determine whether you will need to adjust your tracking mechanism (g/l, spreadsheet, etc.) to accommodate the new terminology and presentation.

- Determine whether in-service long-lived assets have implied time restrictions that will need to be released upon adoption of the ASU.

- Determine if a reclassification note or restatement of net assets is necessary.

- Determine the appropriate presentation among net assets:

- without donor restrictions

- with donor restrictions that will be satisfied over time and/or expenditure

- maintained in perpetuity

- Decide what to present on the face of the financials vs. in the notes.

Considerations for board designations:

- Assemble information about the amounts and purposes of board designations of net assets without donor restrictions.

- Determine the appropriate presentation in notes and/or on the face of the statement of financial position.

- Determine proper presentation of any board-designated endowment funds in the related endowment note.

- Consider drafting new policies and procedures associated with determining board designations to ensure that those designations are documented in the minutes.

It is clear that this ASU will impact all Not-for-Profit/For Purpose Organizations, but it is not a one size fits all standard. The impact will vary from organization to organization. The takeaway from this industry alert is that management should not wait until the last minute to consider the implementation of this ASU. Management and committee members need to allow time to prepare and discuss how to best present the organization's financial statements in a way that will make sense to the users and will best reflect the operations of the organization.

Resources available to assist you with preparing for the upcoming ASU requirements (including example financial statements, notes, checklists and additional guidance) can be found at the following sites:

AICPA - Under interest area not-for-profit

FASB - A copy of the ASU can be downloaded

***

If you have any questions regarding this topic or would like to discuss how it may impact your organization, please contact Maxine G. Romano at Email or 215-441-4600.

Information contained in this alert should not be construed as the rendering of specific accounting, tax, or other advice. Material may become outdated and anyone using this should research and update to ensure accuracy. In no event will the publisher be liable for any damages, direct, indirect, or consequential, claimed to result from use of the material contained in this alert. Readers are encouraged to consult with their advisors before making any decisions.