In August 2016, the Financial Accounting Standards Board (FASB) issued Accounting Standards Update No. 2016-14, Presentation of Financial Statements of Not-for-Profit Entities. As a result, there are many new reporting requirements for NFP/For Purpose entities effective in 2018 for December year-ends and in 2019 for all other NFP/For Purpose entities. This alert describes the new disclosure requirements associated with the organization's available resources and liquidity, highlighting a few helpful tips and providing disclosure examples to assist management in drafting the organization's presentation.

Compliance with the New Standard's Available Resources and Liquidity Disclosures

With the implementation date for this new standard quickly approaching for those organizations with years ending December 2018, and for all other organizations with years ending 2019 following close behind, now is the time to start thinking about how this new requirement will impact your organization.

FASB Accounting Standards Update No. 2016-14, Presentation of Financial Statements of Not-for-Profit Entities (ASU), requires organizations to disclose both qualitative and quantitative information about how the organization manages its liquid resources. The disclosures are intended to clarify the effects of restrictions and other limitations on financial assets, such as those imposed by donors, grantors, laws, contracts, or board decisions.

The disclosures must include the following information:

- Qualitative information that communicates how a NFP manages its liquid resources available to meet cash needs for general expenditures within one year of the date of the statement of financial position. This is generally in a narrative format explaining how the organization manages its funds to meet day-to-day cash needs for general expenditures.

- Quantitative information, either on the face of the statement of financial position or in the notes, and additional qualitative information in the notes as necessary, that communicates the availability of an NFP's financial assets at the date of the statement of financial position to meet cash needs for general expenditures within one year of the date of the statement of financial position. Availability of a financial asset may be affected by (a) its nature, (b) external limits imposed by donors, grantors, laws, and contracts with others, and (c) internal limits imposed by governing board decisions. This disclosure is often seen in a chart format providing numerical details about what liquid assets are available to meet general expenditures.

While the ASU does not dictate the type of qualitative or quantitative information to include, the examples provided below include the following qualitative information:

- The organization's responsibility to maintain resources to meet donor restrictions, which may make those resources unavailable for general expenditures

- The organization's goals for maintaining financial assets

- The organization's policies for investing excess cash

- The organization's policies for spending from board-designated (quasi) endowment funds

- Contractual agreements that make certain financial assets unavailable to fund general expenditures

- Lines of credit that would be drawn down if the organization did not have any liquid, available financial assets

At first glance the new disclosures may appear to be overwhelming; however, the best way to gain an understanding is to read through examples. The ASU includes numerous examples and the AICPA offers many examples and a mocked up financial statement "Saving Our Charities" on their website that includes all ASU changes and requirements.

The following are three examples of qualitative information - aka how the organization manages its cash flow:

- Example 1: NFP A is substantially supported by restricted contributions. Because a donor's restriction requires resources to be used in a particular manner or in a future period, NFP A must maintain sufficient resources to meet those responsibilities to its donors. Thus, financial assets may not be available for general expenditure within one year. As part of NFP A's liquidity management, it has a policy to structure its financial assets to be available as its general expenditures, liabilities, and other obligations come due. In addition, NFP A invests cash in excess of daily requirements in short-term investments. There is a cash management reserve of $150,000 established by the governing board that may be drawn upon in the event of financial distress or an immediate liquidity need resulting from events outside the typical lifecycle of converting financial assets to cash or settling financial liabilities. In the event of an unanticipated liquidity need, NFP A also could draw upon its $1 million unused line of credit (as further discussed in Note X).

- Example 2: NFP B is substantially supported by program revenues. As part of NFP B's liquidity management, it has a policy to structure its financial assets to be available as its general expenditures, liabilities, and other obligations come due. NFP B has $2 million of investments that may be drawn upon in the event of unanticipated financial distress or an immediate liquidity need resulting from events outside the typical life cycle of converting financial assets to cash or settling financial liabilities. NFP B could also could draw upon its $1 million unused line of credit (as further discussed in Note X).

- Example 3: NFP C is primarily supported by contributions. NFP C reviews its liquidity monthly with the finance committee of the board of directors. NFP C has an operating reserve of $50,000, which historically has been sufficient to allow the organization to satisfy its liquidity needs during months of lower revenues. In the event of an unanticipated liquidity need, NFP C also has $100,000 available on its line of credit of $150,000 at December 31, 20X1.

Following are two examples of quantitative information (and qualitative information, as necessary) about the availability of financial assets at the statement of financial position date to meet cash needs for general expenditures within one year of that date:

- Example 1 (non-table format): NFP D has $850,000 of financial assets available within one year of the statement of financial position date to meet cash needs for general expenditures consisting of cash of $50,000, contributions receivable of $500,000, and short-term investments of $300,000. None of the financial assets are subject to donor-imposed or other contractual restrictions that make them unavailable for general expenditures within one year of the statement of financial position. Contributions receivable are subject to implied time restrictions but are expected to be collected within one year.

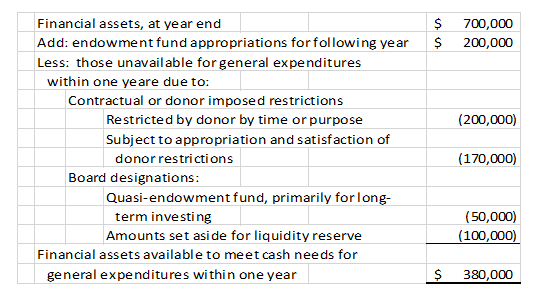

- Example 2 (table format): The following reflects NFP E's financial assets as of the statement of financial position date, reduced by amounts not available for general expenditures because of contractual or donor-imposed restrictions or internal designations. Amounts not available include amounts set aside for long-term investing in board-designated endowments that could be drawn upon if the governing board approves that action. However, amounts available include the Board appropriations from either the donor-restricted endowment or board-designated endowment that are available for general expenditures within one year of the statement of financial position date:

As indicated in our Spring NFP Alert, aside from complying with the new net asset requirements, an additional benefit of tracking the organization's net assets with donor restrictions in greater detail is that the information collected will be useful when drafting the available resource and liquidity note. And let's not forget, the auditors are going to request the information to support this note.

In preparing for implementation of the new available resources and liquidity requirements, and given the new emphasis on board designated net assets, there are some matters that management may want to consider:

- Review current procedures around board designation of net assets. Are procedures formally documented?

- Determine whether any new policies will be required; i.e., board designation policies or operating reserve policies.

- Decide the best presentation of the above information for your organization and begin drafting the notes. It is suggested that you obtain board/committee approval.

- Ensure that you are tracking net assets with donor restrictions: by time, purpose restrictions, and those held in perpetuity so you can easily identify what funds are or are not available for general expenditures.

There is good news regarding this new disclosure: in the period that the amendments are first applied, if the organization is presenting comparative financial statements, it has the option to omit disclosures about liquidity and availability of resources for any periods presented before the period of adoption.

It is clear that this ASU will impact all Not-for-Profit/For Purpose organizations, but it is not a one-size-fits-all standard. The impact will vary from organization to organization. The takeaway from this industry alert is that management should not wait until the last minute to consider the implementation of this ASU. Management and committee members need to allow time to prepare and discuss how best to present the organization's financial statements in a way that will make sense to the users and will best reflect the operations of the organization.

Resources available to assist you with preparing for the upcoming ASU requirements (including example financial statements, notes, checklists, and additional guidance) can be found at the following sites:

AICPA - Under interest area not-for-profit

FASB - A copy of the ASU can be downloaded

***

If you have any questions regarding this topic or would like to discuss how it may impact your organization, please contact Maxine G. Romano at Email or 215-441-4600.

Information contained in this alert should not be construed as the rendering of specific accounting, tax, or other advice. Material may become outdated and anyone using this should research and update to ensure accuracy. In no event will the publisher be liable for any damages, direct, indirect, or consequential, claimed to result from use of the material contained in this alert. Readers are encouraged to consult with their advisors before making any decisions.