Welcome to Kreischer Miller's Tax Season Construction Series, a four part in-depth look at the changes in the Tax Cuts and Jobs Act that affect businesses in the construction industry. In part one of the series, we examined the new rules for meals and entertainment tax deductions. In part two, we examined depreciation and the new rules and return on investment for future purchases. Our third article discusses last minute planning opportunities under the new Section 199A pass-through deduction. In the coming weeks, we'll explore accounting methods.

For a high-level summary of the Tax Cuts and Jobs Act and how it applies to the industry, download our Tax Planning Opportunities for the Construction Industry whitepaper here.

Section 199A provides a 20 percent deduction on the amount of Qualified Business Income (QBI) generated by a qualifying domestic business operated as a partnership, S-Corporation, sole proprietorship, trust, or estate. This deduction, which takes effect for tax years beginning after December 31, 2017, is in response to the approximate 20 percent tax rate cut for C-Corporations and replaces the Domestic Productions Activity Deduction (DPAD).

Final regulations relating to Section 199A were issued by the IRS in January and provided construction contractors with important details relating to how the new provisions are to be applied. This information provides the opportunity to begin tax planning to ensure that construction company owners can fully maximize the available tax benefits. Failure to do so can leave potential tax savings on the table. This alert will highlight some of the planning techniques that are available to construction contractors as well as discuss some of the pitfalls to avoid.

Section 199A applies to all U.S. (including Puerto Rico) non C-corporation taxpayers and is calculated at the individual taxpayer level. The QBI deduction is subject to a number of limitations.

If a business activity is a Specified Service Trade or Business (SSTB), the deduction can either be reduced or eliminated. Most construction companies will not fall under the SSTB designation.

The amount of W-2 wages and qualified property presents another potential limitation which can present significant planning considerations in determining the 199A deduction for construction companies. The deduction is limited to the lesser of 20 percent of the qualified business income OR the greater of 1) 50 percent of the W-2 wages relating to the qualified trade or business, and 2) the sum of 25 percent of the W-2 wages and 2.5 percent of the unadjusted basis of qualified property.

Wages

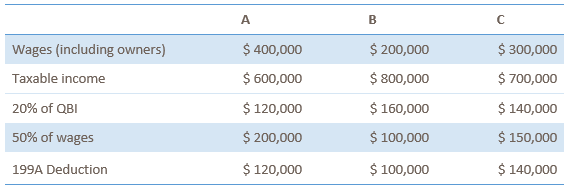

Wages play a major role in the calculation of the 199A deduction. Below are three scenarios that construction contractors may fall into when determining the 20 percent deduction:

In Scenario A (most construction companies), the deduction is limited to 20 percent of QBI. Therefore, reducing owners' wages and increasing QBI will increase the deduction. Consider paying quarterly estimates instead of a bonus to pay safe harbor amounts. If the owner were to reduce his or her wages by $100,000 and take a distribution instead, the deduction would be increased by $20,000. Please remember to take some care to avoid a possible attack by an IRS examiner that the new compensation is not reasonable; i.e., it is too low.

In Scenario B (possible for construction management and A&E firms), the deduction is limited to 50 percent of wages. Therefore, increasing owners' wages will increase the deduction. As with any planning technique, consider the cost of increasing payroll expenses versus the benefit of increasing the 199A deduction.

Scenario C is close to the optimum wage to QBI percentage; 50 percent of wages approximates 20 percent of the QBI.

Another area relating to wages is leased employees. If a developer maintains a separate partnership for all projects but uses one entity for payroll, the payroll can be allocated to the end users of the payroll, thus increasing the 199A deductions.

Subcontracting is very common in the construction industry and subcontractor fees do not qualify as wages. If your company relies heavily on subcontracting, you may want to consider who you can include on payroll to maximize your 199A deduction.

Self-Rental of Business Property

In order to qualify for the 20 percent pass-through deduction, net income must be derived from a qualified "Trade or Business." An operating business that performs construction activities will typically meet this definition. However, real estate activities may not meet this definition, especially if the rental terms involve a triple net lease arrangement wherein the landlord entity carries out no material services in connection with the rental activities. The IRS has provided a safe-harbor to allow real estate to qualify for the deduction. However, the qualifications to meet this safe-harbor may be difficult to achieve.

There are some occasions when a real estate activity could be considered a Trade or Business, especially if the taxpayer is performing significant services related to the management and maintenance of the properties. Much of this analysis is based on the facts and circumstances of the owner's involvement. The IRS has created higher potential penalty assessments in connection with examination adjustments involving QBI issues. If taxpayers incorrectly categorize their real estate activities as qualifying for the 20 percent pass-through deduction, such penalty assertions could arise. As a result, many taxpayers may take a conservative approach and not include real estate activity as part of the new pass-through deduction.

To avoid some of the potential uncertainty in this area, the IRS regulations provide relief to business owners that self-rent the real estate property to their operating business. As long as you meet certain ownership requirements, the real estate activities will automatically qualify for the 20 percent pass-through deduction, even if you have a triple net lease. In order to qualify, you must know the eligibility rules and elect to take this on your income tax return.

The Aggregation Election

A taxpayer can potentially choose to aggregate businesses for the 20 percent pass-through deduction if they operate multiple businesses that coordinate with each other, share resources, and are commonly controlled. The benefit under the aggregation rules is to combine a business that does not have enough of its own W-2 wages or fixed assets to maximize the deduction with another business entity that may have excess W-2 wages and fixed assets. This often leads to both businesses fully maximizing the 20 percent pass-through deduction when making this election. Careful analysis should be done this year to determine which business entities, if any, should make these aggregation elections.

The aggregation election will greatly benefit construction contractors that have their business operations separated into various business entities for liability protection but may have a disproportionate level of payroll or fixed assets in only some of the entities. It could also benefit self-rental arrangements where the construction contractor is renting the business real estate to themselves. This is because the real estate entity on it own will generally have no W-2 wages and not enough property to maximize the benefit of the 20 percent pass-through deduction.

Conclusion

Section 199A can provide a tax benefit, but how to best derive that benefit can be vastly different from taxpayer to taxpayer. It is important to take the time to ensure you are getting the maximum benefit under the Section 199A deduction. There is still time to make certain elections on your 2018 business returns to maximize this benefit. Failure to do so represents the loss of a permanent tax benefit that you can never get back.

***

Look for part four in our Tax Season Construction Series - Accounting Methods - coming soon!

Contact the authors:

Carlo R. Ferri, Director, Tax Strategies at Email.

Michael R. Viens, Director, Tax Strategies at Email

Information contained in this alert should not be construed as the rendering of specific accounting, tax, or other advice. Material may become outdated and anyone using this should research and update to ensure accuracy. In no event will the publisher be liable for any damages, direct, indirect, or consequential, claimed to result from use of the material contained in this alert. Readers are encouraged to consult with their advisors before making any decisions.