The new revenue recognition standard is under the year of adoption. Hopefully your company has begun the process of analyzing your contracts under the 5-step model, and has carefully considered key points of the standard that may affect your revenue recognition policy.

If you have not begun the process of selecting a transition method, there are two options to consider. Additionally, there are a few practical expedients that can be used for each transition method, which can help ease the transition.

1. Modified Retrospective Approach

The modified retrospective approach allows for the new standard to be applied retrospectively with a cumulative catch-up adjustment to retained earnings as of the date of initial application (January 1, 2019 for calendar year-end private companies).

Under this approach, the comparative financial statements will not be restated. This adjustment will recognize the difference between the revenue recognized under legacy GAAP and the contract revenue under the new standard since contract inception. The entity can elect to apply this standard retrospectively to all contracts at the date of initial application or only to contracts that have not been completed at the date of initial application. This election is to be disclosed in the financials.

ASC 606 allows for one practical expedient under the modified retrospective approach that an entity may elect:

- For contracts that have been modified prior to the start of the earliest reporting period presented, the entity will not need to retrospectively restate the contract for modifications. The entity should instead reflect the aggregate effect of all contract modifications that occur prior to the start of the earliest period presented in accordance with ASC 606 when:

- Identifying the satisfied and unsatisfied performance obligations.

- Determining the transaction price.

- Allocating the transaction price to the satisfied and unsatisfied performance obligations.

2. Full Retrospective Approach

The full retrospective approach allows for the new standard to be retrospectively applied to each financial statement reporting period presented. When presenting calendar year 2019 and 2018 in comparative financial statements, 2018 would be restated using the new standard. Entities will need to present the cumulative effect to the earliest period presented, and this should be presented in the carrying amounts of assets and liabilities as of the beginning of the first period presented with offsetting adjustments to opening retained earnings.

ASC 606 allows for four practical expedients under the full retrospective approach that an entity may elect. These include the following:

- There is no need to restate contracts that are started and completed within the same annual reporting period.

- The entity may use the contract transaction price as of the date of completion rather than estimating the variable consideration in the comparative reporting periods for completed contracts with variable consideration.

- The entity will not need to disclose the transaction price that is being allocated to the remaining performance obligations or disclose when the entity expects to recognize the revenue for the reporting periods that are presented before the date of initial application.

- The fourth practical expedient is the same as the one practical expedient allowable for the modified retrospective approach. For contracts that have been modified prior to the start of the earliest reporting period presented, the entity will not need to retrospectively restate the contract for modifications. The entity shall instead reflect the aggregate effect of all contract modifications that occur prior to the start of the earliest period presented in accordance with ASC 606 when:

- Identifying the satisfied and unsatisfied performance obligations.

- Determining the transaction price.

- Allocating the transaction price to the satisfied and unsatisfied performance obligations.

Keep in mind, if any of the above practical expedients are used they must be disclosed by the company. Additionally, there are a number of other practical expedients that fall under other sections of the standard that are allowable, so this list is not all encompassing.

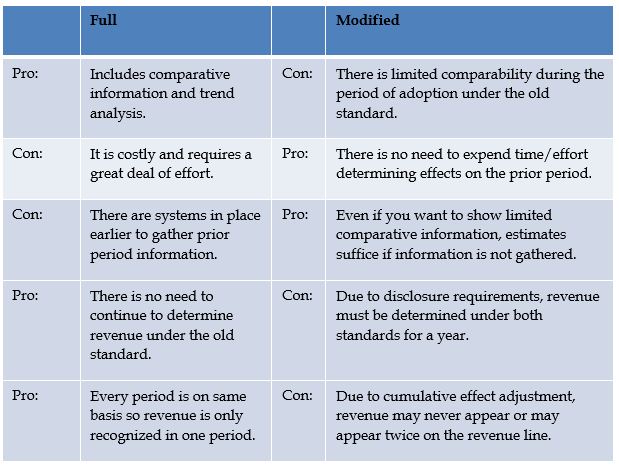

When deciding on the transition method that is appropriate for your company, please consider the pros and cons of each method. Here is a summary:

Having an understanding of the impact of the transition methods and the applicable practical expedients should be helpful as you ease your company into the transition to the new standard. If you have any questions or are unsure of the transition methods and use of practical expedients, Kreischer Miller is here to assist you with the implementation.

***

Contact the author:

Mark A. Guillaume, Director, Audit & Accounting and Construction Industry Group Co-Leader at Email

Information contained in this alert should not be construed as the rendering of specific accounting, tax, or other advice. Material may become outdated and anyone using this should research and update to ensure accuracy. In no event will the publisher be liable for any damages, direct, indirect, or consequential, claimed to result from use of the material contained in this alert. Readers are encouraged to consult with their advisors before making any decisions.