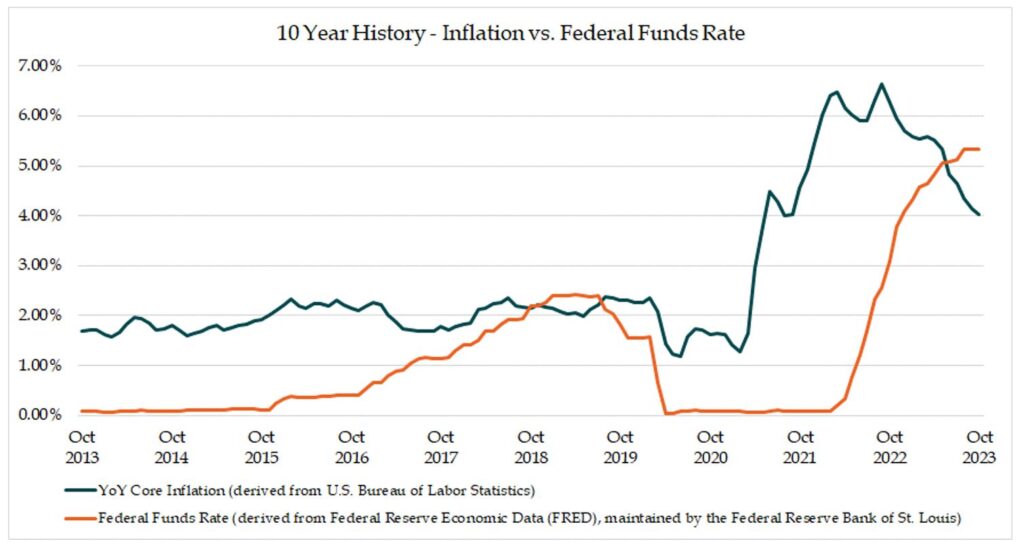

Last year, we discussed how a period of high inflation can impact the value of your business. Since then, the rate of inflation has fallen. The core Consumer Price Index (CPI), which excludes volatile food and energy prices, increased over 6.0 percent on a year-over-year (YoY) basis for much of 2022, but its YoY growth slowed to 4.0 percent by October 2023.

Interest rate hikes have been largely responsible for this decreasing inflation, with the target for the federal funds rate increasing from near-zero in early 2022 to 5.25 percent to 5.50 percent by July of 2023.

With inflation still high (but on the downswing) and high interest rates expected for the foreseeable future, there are several issues businesses should consider.

Was it Real Growth, or Just Inflation?

As a result of inflation-related price increases, many businesses have seen large increases in revenues. It is key for businesses to evaluate how much of their increased revenue represents real, sustainable growth that can be expected to continue in a lower-inflation environment.

One simple way to do this is to isolate the price and the quantity of goods/services being sold. If results have improved solely based on price increases, and the goods/services provided have not changed, it would be prudent to tamper expectations as inflation falls and brainstorm ways to establish more sustainable growth.

From a valuation perspective, the value of a business is based on the future benefits it is expected to generate, which makes generating sustainable growth a crucial factor in increasing business value.

How do High Interest Rates Affect Your Business?

As expected, the federal funds rate increased significantly over 2022 and 2023, with the most recently announced increase coming in July of 2023. The Federal Reserve has abstained from increasing rates further since then, and there is uncertainty as to whether there will be further rate increases. Regardless, there is an expectation that interest rates will remain high for the foreseeable future.

Here are three things to consider in this higher rate environment:

- Excess Cash – Put It to Use. As interest rates have increased, returns on safe, short-term investments such as treasury bills and money market funds have risen to the range of four to six percent, while savings and checking accounts often offer only fractions of a percent in interest. Many commercial banks offer options for businesses to earn a real return on cash while maintaining liquidity, and with high rates, it is more important than ever to put idle cash to work.

- Higher Costs of Borrowing – Be Prepared. Higher interest rates mean more cash out the door for companies that are reliant on borrowing to fund capital expenditures, working capital, growth, acquisitions, and other initiatives. The past year and a half has demonstrated the importance in maintaining flexible cash flow models that account for changing future interest rates. No business wants to find itself empty-handed when it has to pay greater interest on its debt.

- Higher Rates – Lower Value? Higher interest rates increase the rate of return that investors require on their investments. The value of a business is inversely proportional to its required rate of return. As such, with all else being equal, higher interest rates diminish business value. Private company M&A multiples have been largely resilient in the face of these headwinds, with certain industries bearing the brunt of high interest rates more than others. U.S. public stock indices fell during much of 2022, largely because of increased interest rates, but have fought back with a vengeance in 2023 and are approaching highs reached in early 2022. In short, higher interest rates have put a dent into business valuations, but many businesses have found ways to adapt and grow their value despite these challenges.

With interest rates increasing and inflation decreasing, now is an excellent time to take stock of your business. Higher interest rates create risks for businesses in the form of increased cash towards debt service and a higher cost of capital, as well as the potential for a decrease in demand for goods and services.

Meanwhile, the current environment also provides the opportunity for businesses to evaluate the sustainability of their growth and earn a real rate of return on cash. As the inflation roller coaster is on the downswing, businesses should be prepared for whatever comes next.

If you have any questions or would like additional information, please contact a member of our Business Valuation group.