Most M&A deals are conducted on a cash-free, debt-free (CFDF) basis. This means the seller maintains their cash and pays off their debt and debt-like items at the deal closing. Sounds simple enough, right? However, negotiating which items are considered debt-like items can be a complicated process and often has a significant impact on the final purchase price.

What are debt-like items?

There is no one size fits all when defining debt-like items. Certain items such as bank loans, lines of credit, and shareholder loans are clearly identified as debt on the balance sheet. Conversely, debt-like items are often less obvious and may require special consideration.

Debt-like items operate like debt but are typically non-interest bearing and can relate to operational and non-operational liabilities.

Common liabilities to consider and evaluate as debt-like items include the following:

- Deferred revenue and customer deposits

- Long overdue payables

- Credit card liabilities

- Self-insurance accruals

- Accrued bonuses

- Accrued 401k contributions

- Accrued vacation

- Related party payables

- Legal settlements

- Accrued income taxes

- Accrued interest

Classification of these liabilities as debt-like items will depend upon the facts and circumstances of each. Special attention should be made to ensure that each liability is properly evaluated and clearly defined in the purchase agreement and vetted in the due diligence process.

Debt-like items from a buyer and seller perspective

Debt-like items are a common area of debate and disagreement between buyers and sellers. These items are excluded from the amount of working capital that a company is expected to deliver when a transaction closes. Therefore, a buyer would want to classify as many items as possible as debt-like, to ensure that there is a higher level of working capital delivered at the closing date and a lower overall purchase price. In addition, debt-like items are generally expected to be paid in full by the seller before closing or it will result in a reduction to the net proceeds exchanged between both parties.

On the other hand, a seller would want to include debt-like items as working capital deductions to deliver a lower working capital amount and to receive a higher amount of net proceeds from the buyer at closing.

How do debt-like items impact a transaction?

Debt-like items can impact the proceeds of a transaction, influencing the final purchase price and the distribution of funds between buyer and seller.

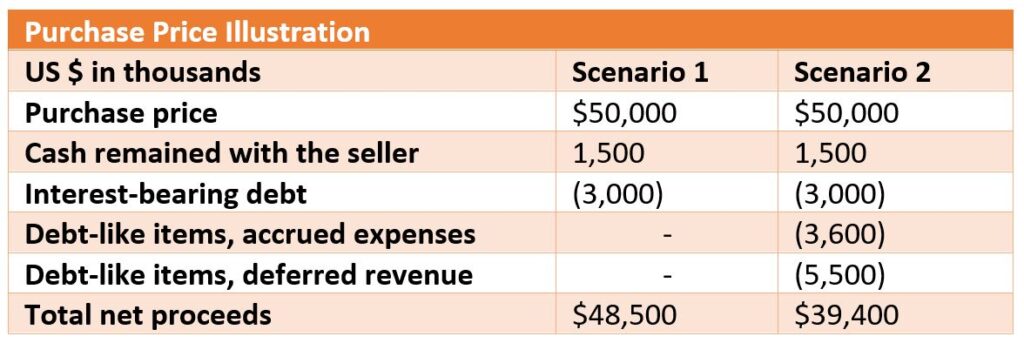

The schedule below illustrates two scenarios after cash and debt-like items are evaluated in an CFDF transaction:

In the chart above, Scenario 1 classified interest-bearing debt as the only debt or debt-like item. In Scenario 2, in addition to interest bearing debt, deferred revenue and certain accrued expenses have been classified as debt and debt-like items. As a result, total cash exchanged under Scenario 2 is lower than the amount determined under Scenario 1.

The treatment of debt-like items should ultimately be addressed in the purchase agreement and can affect various aspects of how a deal is structured. Debt-like items should be discussed and agreed upon as early as possible in the life of the deal. When addressed too late in the deal process, delays in the anticipated closing date of a transaction can occur or may even result in the termination of the proposed deal.

If you would like to learn more about navigating cash-free, debt-like transactions and how it may impact your company, please do not hesitate to contact us.