The business landscape is constantly evolving, and while the past few years saw many companies experience significant growth driven by pandemic-related stimulus and low interest rates, the current climate suggests a shift.

Concerns about a potential U.S. recession in 2025 have intensified, making it crucial for businesses to proactively adapt their growth strategies.

This article discusses the current economic forecasts and emerging best practices, emphasizing how small-to-mid-sized businesses can not only weather a potential economic downturn but also identify opportunities for sustained growth.

Assessing Current Recession Risks in 2025

Understanding the likelihood of an economic recession in 2025 is the first step for businesses in formulating effective preparation strategies.

Aggressive Tariff Policies

Recent economic forecasts from various reputable institutions offer a range of perspectives, yet a common thread of caution emerges. J.P. Morgan research from mid-April indicated a significant probability of a recession occurring in the U.S. by the end of 2025, placing the figure at 60%. This elevated risk is partly attributed to aggressive tariff policies, which could negatively impact both the U.S. and the global economy.

Despite some adjustments to initial tariff measures, the remaining tariffs are still considered a material threat to growth. J.P. Morgan anticipates the Federal Reserve (Fed) will begin easing monetary policy in September 2025, with subsequent rate cuts expected at each meeting through January 2026. This projected easing suggests an expectation of economic deceleration that would warrant such measures.

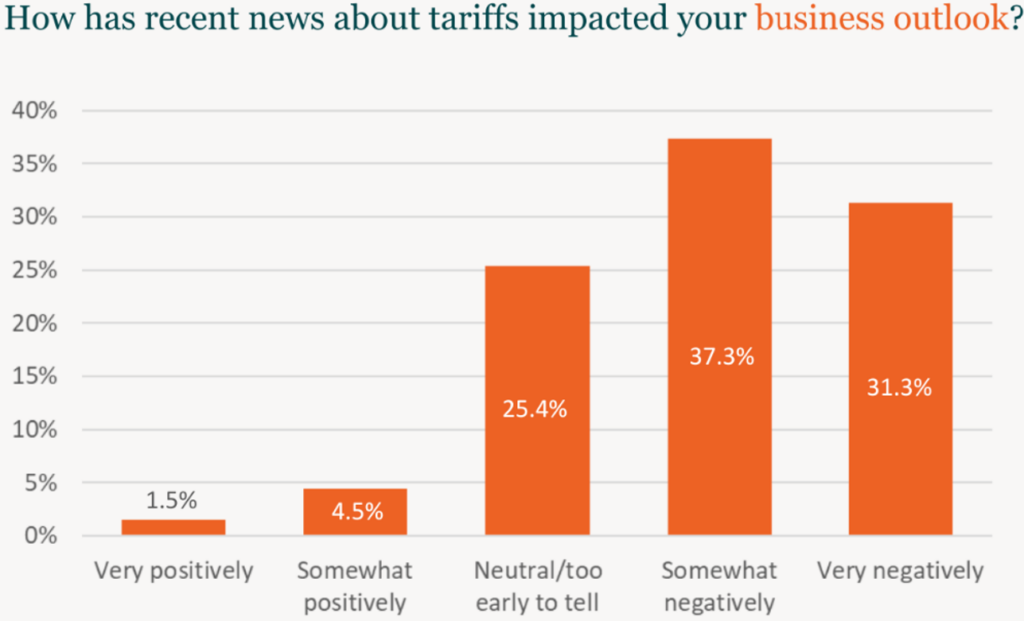

A recurring theme across many economic analyses in 2025 is the significant impact of tariffs and broader policy uncertainty. Tariffs are consistently identified as a major factor contributing to the rising risk of recession, as they are expected to increase prices, disrupt supply chains, and dampen overall economic growth. The unpredictable nature of trade policies creates an unstable environment that makes it difficult for businesses to plan and invest confidently. In fact, upon surveying our clients in our January and April 2025 Private Company Pulse Surveys®, we found that privately held and family-owned businesses have a changed outlook on tariffs this year.

Technical Recession Possibility

RBC, while not explicitly forecasting a technical recession in 2025 (a period in which there have been two consecutive quarters of negative GDP growth), presents a concerning outlook characterized by significantly slower growth. Their April 2025 projections showed growth hovering around 0% for three consecutive quarters in 2025, leaving the U.S. economy highly susceptible to further negative shocks. This near-zero growth environment could easily tip into a recession if unforeseen challenges arise. Furthermore, RBC anticipates persistently high inflation over the next two years and a rising unemployment rate, painting a picture of potential stagflation.

Consumer Confidence

Consumer confidence experienced a significant drop in April 2025, reaching its lowest point since the height of the COVID-19 pandemic. This sharp decline was largely attributed to growing anxieties surrounding President Trump's trade wars, including fears of potential job losses and increasing inflation expectations. Uncertainty surrounding other policy areas, such as immigration and government spending, had also contributed to a decline in both business and consumer confidence.

Consumer confidence rebounded in May 2025, following a pause in tariffs which helped to alleviate some of these concerns.

Adapting Business Strategies for a Potential 2025 Recession

Given the increasing likelihood of an economic slowdown in 2025, small to mid-sized businesses should proactively adapt their strategies to not only weather potential challenges but also identify opportunities for growth. Here are five key areas to focus on:

Refine Your M&A Strategy

As the probability of a recession rises, valuations of potential target companies are expected to decrease. This presents a more favorable landscape for financially stable middle-market companies to strategically acquire businesses that align with their long-term growth objectives.

Identifying companies that enhance existing services, provide access to new markets, or possess valuable technologies could be advantageous. However, in the face of economic uncertainty, thorough due diligence to evaluate the financial health and resilience of potential targets will be more critical than ever.

Sharpen Your Competitive Edge

Economic downturns can create opportunities to attract customers from competitors who may be focused on restructuring. As competitors, including larger public entities, might implement cost-cutting measures, such as potential layoffs and reduced investment in customer service, middle-market companies should actively enhance their sales and marketing efforts.

Maintaining or even increasing investment in building and nurturing customer relationships and providing exceptional service can be a significant differentiator. This period of potential disruption offers a chance to build stronger, long-term customer loyalty by consistently meeting and exceeding customer needs.

Deepen Customer Focus

Maintaining a strong customer focus becomes even more critical in the context of a potential 2025 recession. In an environment where customers may be more cautious with their spending, providing unwavering high-level service is paramount for retention and potential business growth.

Empowering employees to proactively identify and address the evolving needs of customers can not only strengthen loyalty but also uncover new revenue opportunities in a shifting market. Proactive communication, personalized experiences, and a commitment to customer satisfaction will be essential for retaining customers who may be increasingly price-sensitive.

Optimize Operations and Finances

A rigorous review of all operational aspects and financial performance is necessary to identify areas for cost reduction and efficiency improvements. While cutting unnecessary costs is vital for maintaining healthy cash flow, businesses should also strategically allocate resources towards research and development, digital transformation initiatives, and other investments that can drive long-term efficiency and create a sustainable competitive advantage beyond the potential downturn.

Enhance Communication

Transparent and consistent communication with employees, customers, investors, and lenders is essential to navigate the increased economic uncertainty.

Keeping employees informed about the company's plans, strategies, and results can help alleviate anxiety and maintain overall performance. Regular and honest updates to investors and lenders regarding the company's financial health and proactive preparation strategies will be crucial for ensuring continued support and access to financing if needed.

The Silver Lining: Always Seizing New Opportunities

The economic outlook for 2025 presents a landscape marked by significant uncertainty, with many forecasts pointing towards a potential slowdown or even a recession. While this environment poses challenges for businesses, it also underscores the critical importance of proactive planning and strategic adaptation.

By implementing strategies focused on cost management, cash flow optimization, and diversification, businesses can lay a strong foundation for navigating the potential headwinds.

Moreover, businesses, particularly middle-market companies, should be prepared to seize the unique opportunities that often arise during economic downturns, such as strategic acquisitions, talent acquisition, and gaining market share by focusing on customer needs.

Businesses that take proactive steps now, informed by expert guidance and a strategic growth mindset, will be better positioned not only to weather potential economic slowness but also to emerge stronger and more competitive in the long run.

Growth Strategies from Kreischer Miller

Some of today’s strongest businesses were built during the most challenging economic times because they had the courage to go “risk-on” when the rest of the world was going “risk-off.”

However, taking a step back to reevaluate new opportunities might just help you lay the foundation for an even stronger business on the other side of a downturn.

Our team can provide the expertise and support needed to navigate the economic landscape of 2025. Contact us today to talk about ways to grow your business this year and beyond.