We have just completed two government M&A transactions in the last 30 days and we are currently working on two more. From what we’ve seen and heard, the multiples of EBITDA being paid are increasing, which begs a question: Are buyers willing to pay more because of anticipated reductions in income tax rates?

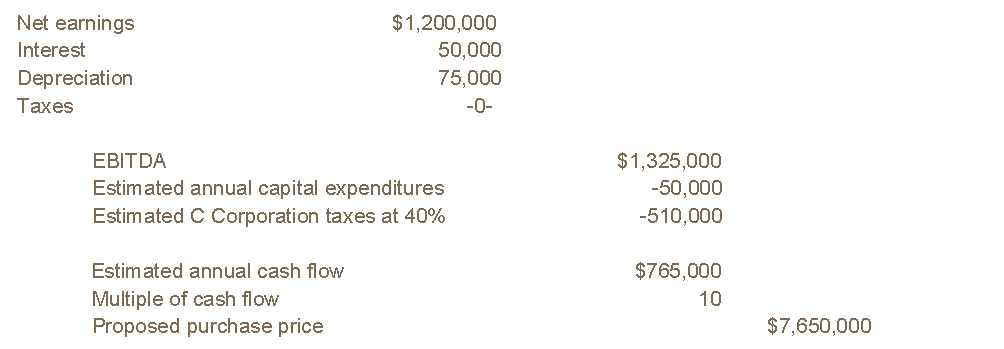

Let’s walk through an example of a $20 million S Corporation that’s being bought by a public company that is a C Corporation. The C Corp’s valuation of the S Corporation probably looks something like this, based on today’s effective corporate tax rates of approximately 40 percent:

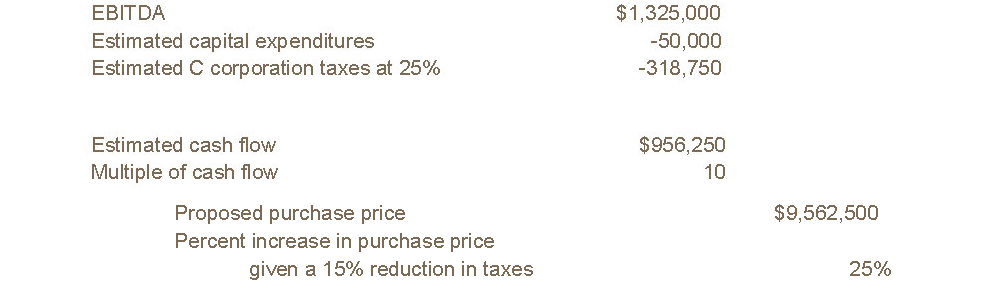

Under President Trump’s tax proposal, C Corporation federal tax rates would be slashed from 35 percent to 15 percent, to increase U.S. competitiveness in the global market. It has also been suggested that some of these tax cuts will apply to pass-through entities. With the Republicans in control of both the House and the Senate, there is a higher likelihood of such tax reductions in 2016, albeit maybe not as much as the President has proposed. To illustrate the impact of the potential change on transactions, let’s revisit the example above assuming that overall corporate tax rates are reduced to 25 percent.

Many people, myself included, think this is a major reason why we have seen such a jump in the stock market since the election. If correct, it’s reasonable to expect that many companies may benefit from a reduction of tax rates, and such a change could enhance multiples in buy/sell transactions. However, tax reform has a history of being highly elusive, so buyer and seller beware!

David E. Shaffer can be reached at Email or 215.441.4600.

You may also like: